- 1. Introduction to Macroeconomics2h 3m

- 2. Introductory Economic Models1h 9m

- 3. Supply and Demand3h 20m

- Introduction to Supply and Demand4m

- The Basics of Demand6m

- Individual Demand and Market Demand3m

- Shifting Demand38m

- The Basics of Supply2m

- Individual Supply and Market Supply6m

- Shifting Supply25m

- Overview of Supply and Demand Shifts7m

- Supply and Demand Together: Equilibrium, Shortage, and Surplus8m

- Supply and Demand Together: One-sided Shifts20m

- Supply and Demand Together: Both Shift34m

- Supply and Demand: Quantitative Analysis40m

- 4. Elasticity2h 25m

- Percentage Change and Price Elasticity of Demand18m

- Elasticity and the Midpoint Method20m

- Price Elasticity of Demand on a Graph11m

- Determinants of Price Elasticity of Demand6m

- Total Revenue Test13m

- Total Revenue Along a Linear Demand Curve14m

- Income Elasticity of Demand23m

- Cross-Price Elasticity of Demand11m

- Price Elasticity of Supply12m

- Price Elasticity of Supply on a Graph3m

- Elasticity Summary9m

- 5. Consumer and Producer Surplus; Price Ceilings and Price Floors3h 11m

- WIllingness to Pay and Consumer Surplus18m

- Willingness to Sell and Producer Surplus12m

- Economic Surplus and Efficiency18m

- Quantitative Analysis of Consumer and Producer Surplus at Equilibrium28m

- Price Ceilings, Price Floors, and Black Markets38m

- Quantitative Analysis of Price Ceilings and Floors: Finding Points20m

- Quantitative Analysis of Price Ceilings and Floors: Finding Areas54m

- 6. Introduction to Taxes1h 29m

- 7. Externalities54m

- 8. The Types of Goods1h 3m

- 9. International Trade1h 16m

- 10. Measuring National Output and Income 54m

- 11. Unemployment and Inflation1h 34m

- Labor Force and Unemployment10m

- Types of Unemployment12m

- Unemployment: Minimum Wage Laws and Efficiency Wages7m

- Inflation and Consumer Price Index (CPI)16m

- Using CPI to Adjust for Inflation7m

- Problems with the Consumer Price Index (CPI)5m

- Nominal Income and Real Income12m

- Nominal Interest, Real Interest, and the Fisher Equation5m

- Who is Affected by Inflation?5m

- Demand-Pull and Cost-Push Inflation6m

- Costs of Inflation: Shoe-leather Costs and Menu Costs4m

- 12. Productivity and Economic Growth1h 3m

- 13. The Financial System1h 30m

- 14. Income and Consumption52m

- 15. Deriving the Aggregate Expenditures Model1h 14m

- 16. Aggregate Demand and Aggregate Supply Analysis1h 22m

- Aggregate Demand17m

- Deriving Aggregate Demand from the Aggregate Expenditure Model12m

- Shifting Aggregate Demand4m

- Long Run Aggregate Supply9m

- Short Run Aggregate Supply7m

- Shifting Short Run Aggregate Supply8m

- AD-AS Model: Equilibrium in the Short Run and Long Run5m

- AD-AS Model: Shifts in Aggregate Demand18m

- 17. The Monetary System58m

- The Functions of Money; The Kinds of Money8m

- Defining the Money Supply: M1 and M22m

- Required Reserves and the Deposit Multiplier8m

- Introduction to the Federal Reserve8m

- The Federal Reserve and the Money Supply11m

- History of the US Banking System9m

- The Financial Crisis of 2007-2009 (The Great Recession)10m

- 18. Monetary Policy1h 26m

- 19. Fiscal Policy52m

- 20. Tradeoffs Between Inflation and Unemployment1h 2m

- 21. Open-Economy Macroeconomics1h 44m

- Balance of Payments: Introduction5m

- Balance of Payments: Current Account8m

- Balance of Payments: Financial Account and Capital Account7m

- Net Exports Equal Net Foreign Investment7m

- Balance of Trade; Trade Deficit and Trade Surplus6m

- Exchange Rates: Introduction14m

- Exchange Rates: Nominal and Real13m

- Exchange Rates: Equilibrium8m

- Exchange Rates: Shifts in Supply and Demand11m

- Exchange Rates and Net Exports6m

- Exchange Rates: Purchasing Power Parity3m

- The Gold Standard4m

- The Bretton Woods System6m

- 22. Macroeconomic Schools of Thought40m

- 23. Dynamic AD/AS Model32m

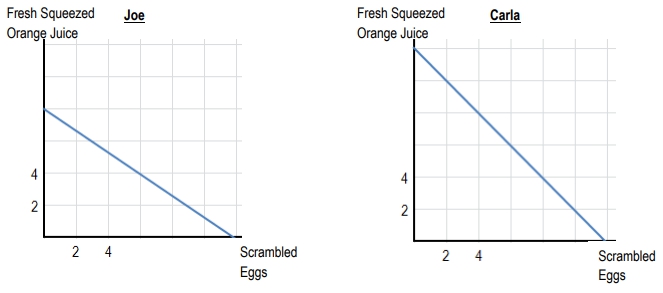

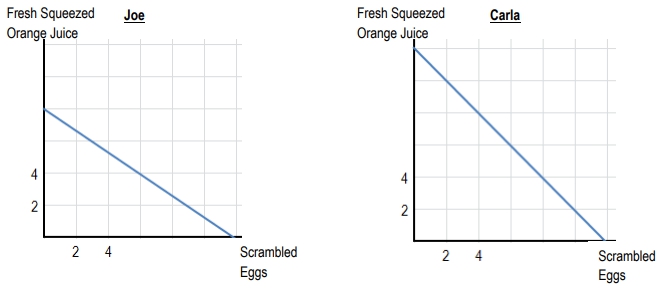

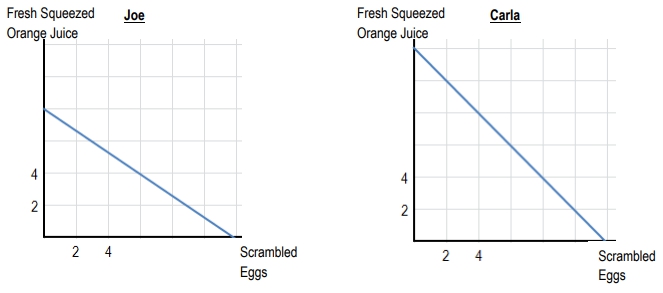

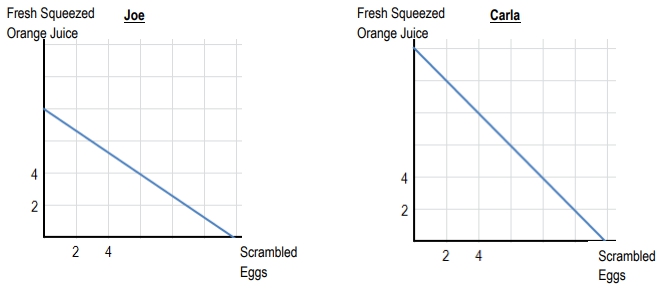

PPF - Comparative Advantage and Absolute Advantage: Videos & Practice Problems

Who has the absolute advantage in making scrambled eggs?

Who has the absolute advantage in making fresh squeezed orange juice?

Who has the comparative advantage in making scrambled eggs?

Who has the comparative advantage in making fresh squeezed orange juice?

Do you want more practice?

Here’s what students ask on this topic:

Absolute advantage refers to the ability of an individual, firm, or country to produce more of a good using the same amount of resources compared to others. For example, if your friend can produce 30 pizza rolls while you can only produce 10 with the same time and resources, your friend has the absolute advantage in pizza rolls. Comparative advantage, on the other hand, is about producing a good at a lower opportunity cost. It means that even if one person is better at producing both goods, there is still a benefit to trade because each person should specialize in the good they give up less of. This concept helps explain why trade and specialization increase overall efficiency and output.

To calculate the opportunity cost of producing one good, you divide the maximum amount of the other good that could be produced by the maximum amount of the good in question. For example, if you can produce a maximum of 20 gallons of hunch punch or 10 batches of pizza rolls, the opportunity cost of 1 pizza roll is given by the MathML equation: , which equals 2 gallons of hunch punch. This means producing one pizza roll costs you 2 gallons of hunch punch. Conversely, the opportunity cost of 1 gallon of hunch punch is = 0.5 pizza rolls. This method helps identify which good has a lower opportunity cost and thus comparative advantage.

Specialization based on comparative advantage allows individuals or countries to focus on producing goods for which they have the lowest opportunity cost. This leads to more efficient use of resources and higher total output. For example, if you have a comparative advantage in producing hunch punch (lower opportunity cost) and your friend has a comparative advantage in pizza rolls, by specializing and trading, both of you can enjoy more of both goods than if you tried to produce both independently. This principle underlies much of international trade and explains how cooperation can improve overall economic welfare.

Yes, a person or country can have an absolute advantage in producing both goods, meaning they can produce more of both with the same resources. However, comparative advantage still applies because what matters is the opportunity cost of producing each good. Even if one party is more productive in both goods, the other party will have a lower opportunity cost in producing one of the goods. By specializing according to comparative advantage and trading, both parties can benefit and consume more than they could alone.

The production possibilities frontier (PPF) shows the maximum combinations of two goods that can be produced with fixed resources and technology. The slope of the PPF represents the opportunity cost of one good in terms of the other. A steeper slope means a higher opportunity cost. By comparing the slopes of two producers' PPFs, we can identify who has the lower opportunity cost for each good, indicating comparative advantage. This graphical tool helps visualize trade-offs and the benefits of specialization and trade.