Taxes play a crucial role in funding public services such as education, police, and fire departments. The government collects taxes to ensure these essential services are available to the public. In this context, taxes can be imposed on either the buyer or the seller, and we will focus on per unit taxes, which are charged for each unit exchanged. For instance, if a \$1 tax is levied on a product, a buyer purchasing one unit pays the unit price plus an additional \$1 in tax.

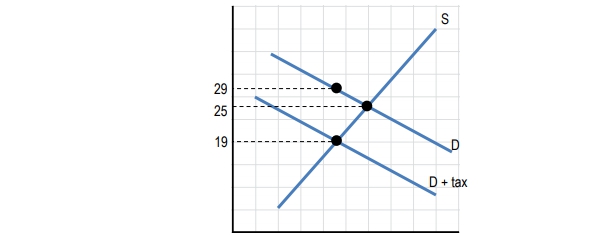

When a tax is imposed, it affects the supply and demand curves in the market. Specifically, the curve will shift to the left by the amount of the tax, indicating a decrease in the quantity exchanged at equilibrium. This shift results in a new equilibrium price, which is different for buyers and sellers. The price paid by the buyer (denoted as \( P_B \)) includes the tax, while the seller receives a lower price (denoted as \( P_S \)) after the tax is deducted. For example, if the buyer pays \$7.10 for a product with a \$2 tax, the seller only receives \$5.10.

Regardless of whether the tax is imposed on the buyer or the seller, the market ultimately reaches the same equilibrium price and quantity. This is because the tax burden is shared between the two parties. The concept of tax incidence refers to how the burden of the tax is distributed. In our example, if the consumer's price increases from \$6 to \$7.10, they bear a tax incidence of \$1.10, while the seller's price decreases from \$6 to \$5.10, resulting in a tax incidence of \$0.90. This means the consumer pays 55% of the tax burden, while the producer pays 45%.

In summary, the imposition of taxes leads to a shift in market equilibrium, affecting both buyers and sellers. The total tax burden is shared, and understanding how this burden is distributed is essential for analyzing the impact of taxation on market dynamics.