Externalities are costs or benefits that affect individuals not directly involved in a transaction, such as pollution or the societal benefits of vaccinations. To address these externalities, the government can implement strategies to internalize them, meaning that the costs or benefits are accounted for in market transactions. This ensures that all parties involved consider the full impact of their actions.

One approach the government can take is through command and control policies, which involve regulations that mandate or prohibit certain behaviors. For instance, to combat negative externalities like pollution, the government may prohibit factories from dumping chemicals into rivers, thereby forcing them to find safer disposal methods. Conversely, to promote positive externalities, such as the societal benefits of education, the government may require compulsory schooling to ensure that everyone receives an education, recognizing its broader benefits to society.

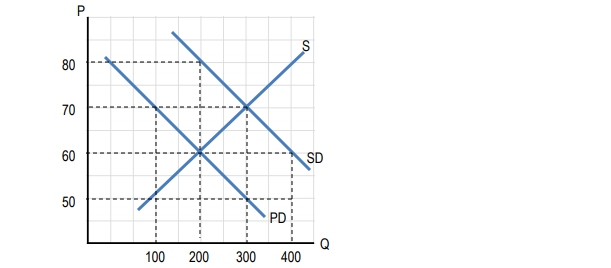

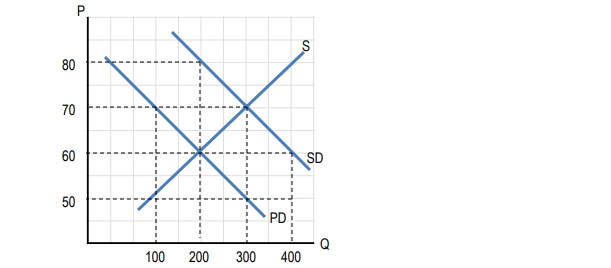

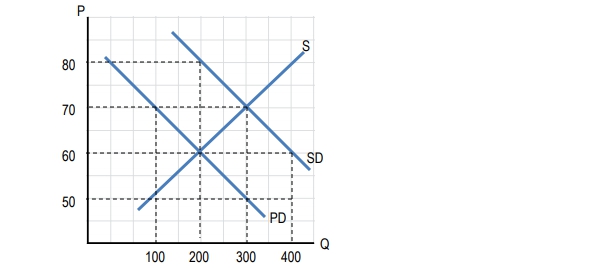

Another method is the use of market-based policies, including corrective taxes and subsidies, often referred to as Pigovian taxes, named after economist Arthur Pigou. These taxes are designed to equal the external cost of a negative externality, such as pollution. By imposing a tax equivalent to the cost of pollution, the government can shift the supply curve to reflect the true social cost, leading to a new equilibrium quantity that accounts for the externality. This tax effectively raises the cost of production, reducing the quantity produced to a more socially optimal level.

For example, if a factory's pollution imposes a cost on society, the government can impose a tax that reflects this cost. The difference between the price consumers pay and the price producers receive represents the tax amount, which helps to reduce the quantity produced to a more efficient level. This approach acknowledges that while pollution is undesirable, some level of it may be necessary for economic efficiency, as it can contribute to beneficial activities.

On the other hand, when dealing with positive externalities, such as education, the government can provide subsidies to encourage higher production levels. By subsidizing education, the government can shift the demand curve to reflect the additional societal benefits, leading to an increase in the quantity of educated individuals, which is beneficial for society as a whole.

In summary, the government can effectively address externalities through command and control regulations or market-based solutions like corrective taxes and subsidies. By aligning private costs and benefits with social costs and benefits, these interventions help to achieve a more efficient allocation of resources in the economy.