When a tax is imposed on a market, it generates tax revenue for the government, which can be calculated using the formula:

Tax Revenue = Tax Amount × Quantity Sold (QT)

This tax revenue is represented graphically as a rectangle, where the height is the tax amount and the width is the quantity exchanged after the tax is applied. The introduction of a tax disrupts market equilibrium, leading to different prices for buyers and sellers, which in turn affects economic surplus.

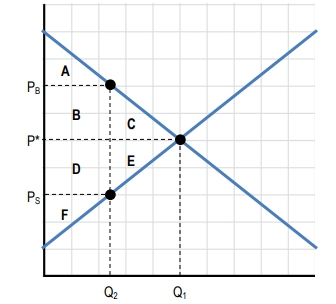

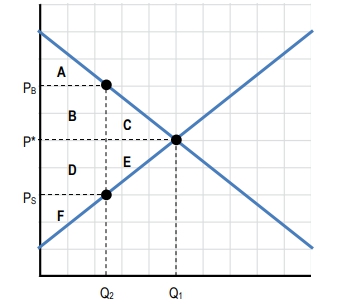

Economic surplus is the sum of consumer surplus and producer surplus. In a tax-free market, at equilibrium price (P*), consumer surplus includes the area above the price and below the demand curve, while producer surplus is the area below the price and above the supply curve. Together, they maximize total surplus, represented by the areas A, B, C (consumer surplus) and D, E, F (producer surplus).

However, when a tax is introduced, consumer surplus decreases significantly. The new consumer surplus is only the area above the buyer's price and below the demand curve, which is now just area A. Producer surplus also diminishes, as producers receive a lower price, resulting in only area F being counted as surplus. The areas B and D represent the tax revenue generated, which is the rectangle formed by the tax amount and the quantity sold after the tax.

Despite the tax revenue being a part of the total economic surplus, the overall surplus decreases due to the loss of areas C and E, which are no longer part of consumer and producer surplus. This loss is termed deadweight loss, represented by the areas C and E, indicating trades that do not occur because the market is no longer operating at the efficient quantity.

In summary, while a tax generates revenue for the government, it also leads to a reduction in economic surplus and creates deadweight loss, illustrating the trade-offs involved in tax policy. The overall economic surplus after a tax is calculated as:

Total Economic Surplus = Consumer Surplus (A) + Producer Surplus (F) + Tax Revenue (B + D)

However, it is important to note that the total surplus is less than it would be without the tax, highlighting the inefficiencies introduced by taxation in the market.