8. Long Lived Assets

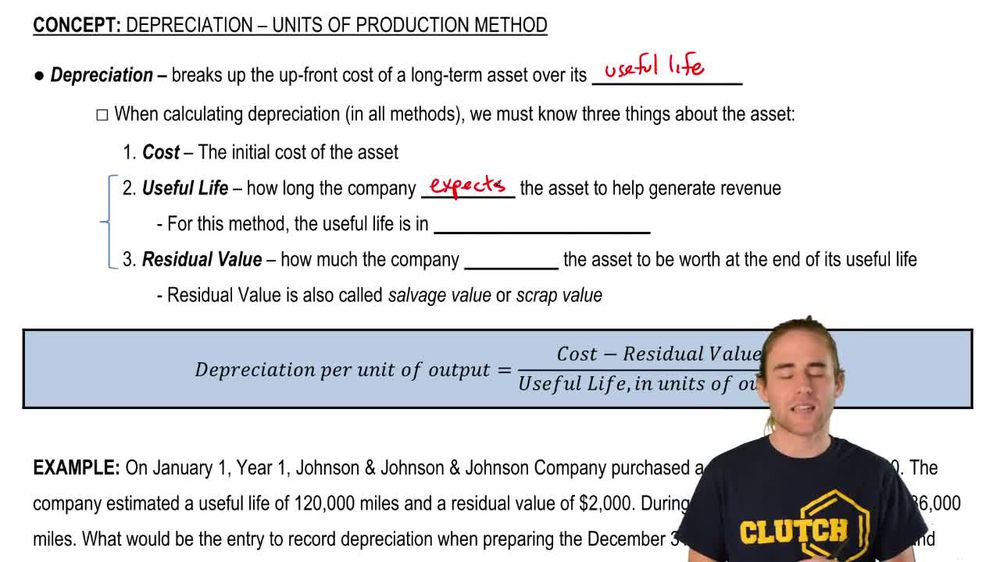

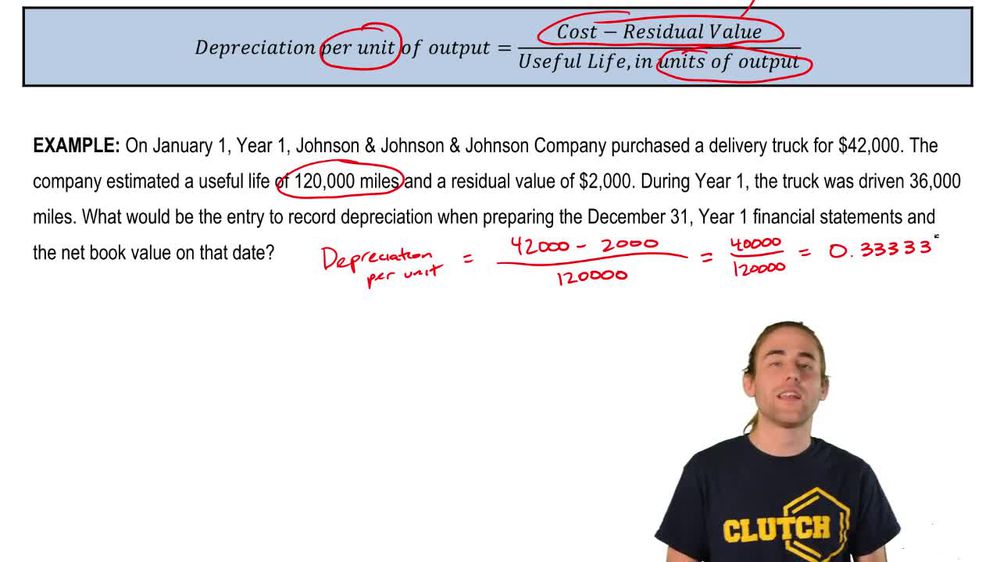

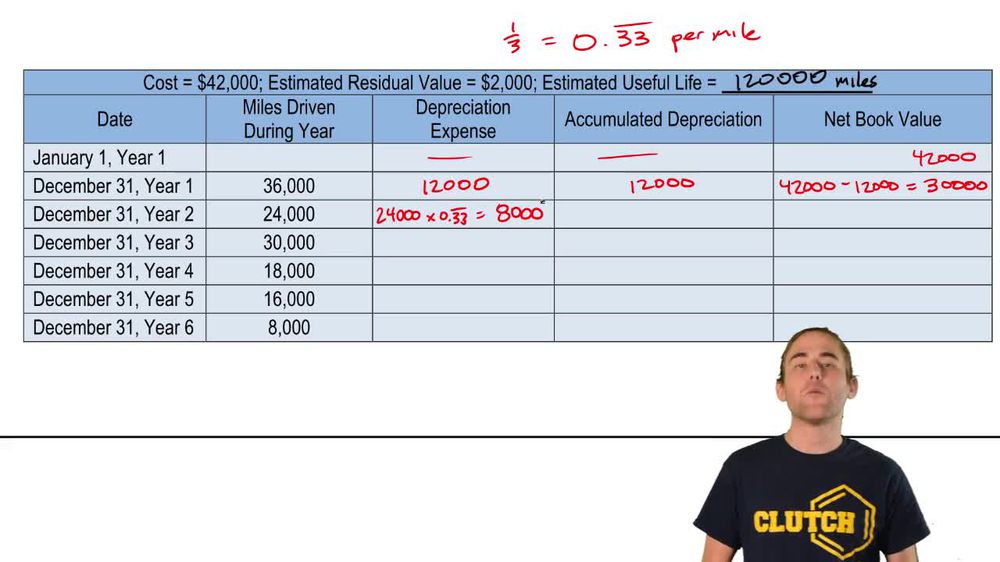

Depreciation: Units-of-Activity

Practice this topic

- Multiple Choice

ABC Company purchased a new machine on January 1, Year 1 for \$44,000. The company expects the machine to produce 50,000 units. The company thinks it could sell the scrap metal from the machine for \$4,000 at the end of its useful life. If the company uses the units-of-production method for depreciation, what will be the net book value of the machine on December 31, Year 1, if 15,000 units are produced with the machine during the year?

- Multiple Choice

DBQ Company purchased a machine on January 1, Year 1 for \$60,000. The company estimated a 300,000 unit production useful life and \$8,000 residual value. During Year 1, the company produced 90,000 units. During Year 2, the company produced 30,000 units. If the company uses the units-of-production method for depreciation, what will be the amount of accumulated depreciation on December 31, Year 2?

- Multiple Choice

XYZ Company purchased a machine on January 1, 2018 for \$110,000. The company estimated a 20,000 unit useful life and \$10,000 residual value. XYZ produced 8,000 units in 2018; 6,000 units in 2019; and 10,000 units in 2020. If the company uses the units-of-production method for depreciation, what will be the amount of depreciation expense for the year 2020?