- 0. Basic Principles of Economics1h 5m

- Introduction to Economics3m

- People Are Rational2m

- People Respond to Incentives1m

- Scarcity and Choice2m

- Marginal Analysis9m

- Allocative Efficiency, Productive Efficiency, and Equality7m

- Positive and Normative Analysis7m

- Microeconomics vs. Macroeconomics2m

- Factors of Production5m

- Circular Flow Diagram5m

- Graphing Review10m

- Percentage and Decimal Review4m

- Fractions Review2m

- 1. Reading and Understanding Graphs59m

- 2. Introductory Economic Models1h 10m

- 3. The Market Forces of Supply and Demand2h 26m

- Competitive Markets10m

- The Demand Curve13m

- Shifts in the Demand Curve24m

- Movement Along a Demand Curve5m

- The Supply Curve9m

- Shifts in the Supply Curve22m

- Movement Along a Supply Curve3m

- Market Equilibrium8m

- Using the Supply and Demand Curves to Find Equilibrium3m

- Effects of Surplus3m

- Effects of Shortage2m

- Supply and Demand: Quantitative Analysis40m

- 4. Elasticity2h 26m

- Percentage Change and Price Elasticity of Demand19m

- Elasticity and the Midpoint Method20m

- Price Elasticity of Demand on a Graph11m

- Determinants of Price Elasticity of Demand6m

- Total Revenue Test13m

- Total Revenue Along a Linear Demand Curve14m

- Income Elasticity of Demand23m

- Cross-Price Elasticity of Demand11m

- Price Elasticity of Supply12m

- Price Elasticity of Supply on a Graph3m

- Elasticity Summary9m

- 5. Consumer and Producer Surplus; Price Ceilings and Floors3h 45m

- Consumer Surplus and Willingness to Pay38m

- Producer Surplus and Willingness to Sell26m

- Economic Surplus and Efficiency18m

- Quantitative Analysis of Consumer and Producer Surplus at Equilibrium28m

- Price Ceilings, Price Floors, and Black Markets38m

- Quantitative Analysis of Price Ceilings and Price Floors: Finding Points20m

- Quantitative Analysis of Price Ceilings and Price Floors: Finding Areas54m

- 6. Introduction to Taxes and Subsidies1h 46m

- 7. Externalities1h 12m

- 8. The Types of Goods1h 13m

- 9. International Trade1h 16m

- 10. The Costs of Production2h 35m

- 11. Perfect Competition2h 23m

- Introduction to the Four Market Models2m

- Characteristics of Perfect Competition6m

- Revenue in Perfect Competition14m

- Perfect Competition Profit on the Graph20m

- Short Run Shutdown Decision33m

- Long Run Entry and Exit Decision18m

- Individual Supply Curve in the Short Run and Long Run6m

- Market Supply Curve in the Short Run and Long Run9m

- Long Run Equilibrium12m

- Perfect Competition and Efficiency15m

- Four Market Model Summary: Perfect Competition5m

- 12. Monopoly2h 13m

- Characteristics of Monopoly21m

- Monopoly Revenue12m

- Monopoly Profit on the Graph16m

- Monopoly Efficiency and Deadweight Loss20m

- Price Discrimination22m

- Antitrust Laws and Government Regulation of Monopolies11m

- Mergers and the Herfindahl-Hirschman Index (HHI)17m

- Four Firm Concentration Ratio6m

- Four Market Model Summary: Monopoly4m

- 13. Monopolistic Competition1h 9m

- 14. Oligopoly1h 26m

- 15. Markets for the Factors of Production1h 26m

- 16. Income Inequality and Poverty35m

- 17. Asymmetric Information, Voting, and Public Choice39m

- 18. Consumer Choice and Behavioral Economics1h 16m

PPF - Comparative Advantage and Absolute Advantage: Videos & Practice Problems

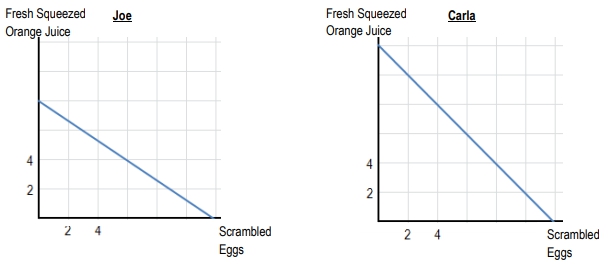

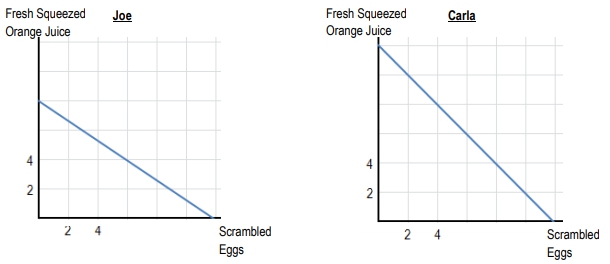

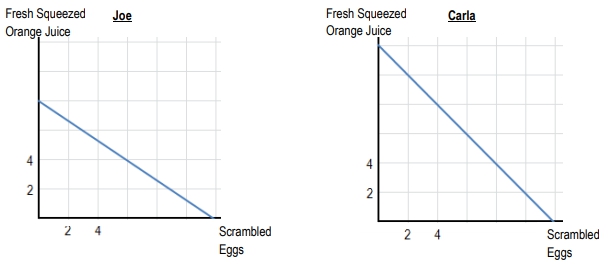

Everyone has different levels of productivity. Who's better at making what? How do we define "better"?

Who has the absolute advantage in making scrambled eggs?

Who has the absolute advantage in making fresh squeezed orange juice?

Who has the comparative advantage in making scrambled eggs?

Who has the comparative advantage in making fresh squeezed orange juice?

Do you want more practice?

Here’s what students ask on this topic:

Absolute advantage refers to the ability of an individual, firm, or country to produce more of a good or service with the same amount of resources compared to others. In contrast, comparative advantage focuses on producing goods or services at a lower opportunity cost. This means that even if one party has an absolute advantage in producing all goods, they can still benefit from trade by specializing in the goods for which they have a comparative advantage. This specialization and trade can lead to more efficient resource allocation and increased overall production.

To calculate opportunity cost, you need to determine the maximum output of two goods. For example, if you can produce either 20 gallons of hunch punch or 10 batches of pizza rolls, the opportunity cost of producing one batch of pizza rolls is the amount of hunch punch you give up. The formula is:

So, the opportunity cost of one pizza roll is 20/10 = 2 gallons of hunch punch. Conversely, the opportunity cost of one gallon of hunch punch is 10/20 = 0.5 pizza rolls.

Comparative advantage is crucial in trade because it allows for specialization, which leads to more efficient resource allocation and increased overall production. When individuals, firms, or countries specialize in producing goods for which they have a lower opportunity cost, they can trade to obtain other goods at a lower cost than if they produced everything themselves. This specialization and trade result in mutual benefits, higher productivity, and improved economic welfare for all parties involved.

No, a country cannot have a comparative advantage in producing all goods. Comparative advantage is based on the concept of opportunity cost. Even if a country has an absolute advantage in producing all goods, it will still have a lower opportunity cost for some goods compared to others. This means that it will have a comparative advantage in producing certain goods while other countries will have a comparative advantage in producing different goods. This difference in opportunity costs is what makes trade beneficial.

Specialization is the process of focusing on the production of a particular good or service in which an individual, firm, or country has a comparative advantage. By specializing, they can produce more efficiently and at a lower opportunity cost. This specialization allows for increased overall production and efficiency. When specialized producers trade with each other, they can obtain other goods at a lower cost than if they tried to produce everything themselves, leading to mutual benefits and higher economic welfare.