The concepts of consumer and producer surplus are crucial in understanding market structures, particularly in monopolies compared to perfect competition. In a perfectly competitive market, firms produce at an efficient quantity where marginal cost equals marginal revenue, leading to maximum total surplus without any deadweight loss. Here, consumer surplus is represented by the area above the price and below the demand curve, while producer surplus is the area below the price and above the supply curve. The total surplus in this scenario is the sum of consumer and producer surplus, encompassing all trades made at the efficient quantity.

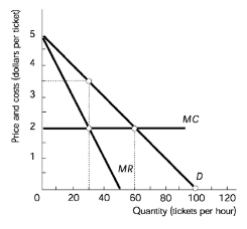

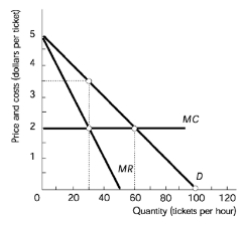

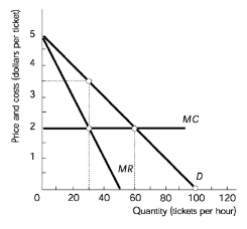

In contrast, a monopoly restricts output to maximize profits, resulting in a lower quantity produced than the efficient level. This leads to a higher price for consumers, which reduces consumer surplus. The consumer surplus in a monopoly is diminished as consumers lose the surplus represented by the areas that are no longer accessible due to the higher price and lower quantity. The producer surplus, however, may increase as the monopoly can charge a higher price for the limited quantity sold, but this comes at the cost of lost trades that would have occurred at a lower price.

The deadweight loss in a monopoly arises from the trades that do not occur due to the restricted quantity. This loss is represented by the areas of surplus that are no longer realized, specifically the areas that would have contributed to total surplus in a competitive market. Thus, the total surplus in a monopoly is reduced, highlighting the inefficiencies inherent in monopolistic structures.

When discussing efficiency, it is essential to differentiate between productive and allocative efficiency. Productive efficiency occurs when goods are produced at the lowest possible cost, typically at the minimum point of the average total cost curve. In a monopoly, firms do not achieve this efficiency as they operate on the downward-sloping part of the average total cost curve, failing to produce at the minimum cost. Allocative efficiency, on the other hand, is achieved when production aligns with consumer preferences, where the price equals the marginal cost. Monopolies do not reach allocative efficiency either, as they produce less than the efficient quantity, leading to a situation where the marginal benefit to consumers exceeds the marginal cost of production.

In summary, monopolies create a scenario where both productive and allocative efficiencies are absent, resulting in a decrease in total surplus and the presence of deadweight loss. Understanding these concepts is vital for analyzing the implications of monopolistic practices on consumer welfare and market efficiency.