In accounting, the rule of conservatism plays a crucial role in how we recognize losses and gains. This principle dictates that we should be more cautious when recording losses compared to gains. When an asset loses value, it is essential to recognize that loss in the period it occurs. For instance, if a machine's lifespan is reassessed and found to be shorter than expected, its value should be adjusted downward immediately. Conversely, if an asset appreciates in value, such as land, we do not recognize that gain until the asset is sold. This ensures that we only report gains that are realized, maintaining a conservative approach to financial reporting.

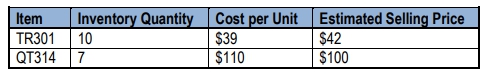

When it comes to inventory valuation, the concept of "lower of cost or market" is applied. This means that inventory must be recorded at the lower value between its historical cost and its current market value. The market value can be defined as the net realizable value or the current replacement cost. For example, if inventory was purchased at \$50 per unit but is now available for \$30 due to changes in production costs, the current replacement cost would be \$30. The net realizable value, on the other hand, considers the estimated selling price minus any selling expenses. If the estimated selling price is \$50 and selling expenses are \$7, the net realizable value would be \$43.

To illustrate this, consider a scenario where Opso Corp purchased inventory for \$84,000 four years ago. Currently, the estimated selling price is \$86,000, with selling expenses of \$7,000. To determine the appropriate inventory valuation, we first calculate the net realizable value: \$86,000 (selling price) - \$7,000 (selling expenses) = \$79,000. We then compare this with the historical cost of \$84,000. Since \$79,000 is lower than \$84,000, we must record the inventory at \$79,000.

In accounting entries, this write-down is reflected as a loss. The journal entry would involve debiting the loss from the write-down of inventory for \$5,000 (the difference between the historical cost of \$84,000 and the new market value of \$79,000) and crediting the inventory account to reduce its value. This process ensures that the financial statements accurately reflect the current value of the inventory, adhering to the principles of conservatism and proper inventory valuation.