Transactions are fundamental events that occur continuously within a company, representing exchanges where something is given up in return for something else. For instance, when a company purchases land, it exchanges cash for the land, or when it sells a product, it gives up inventory in exchange for revenue. Each transaction impacts at least two accounts, which can include cash, accounts receivable, accounts payable, investment accounts, and retained earnings.

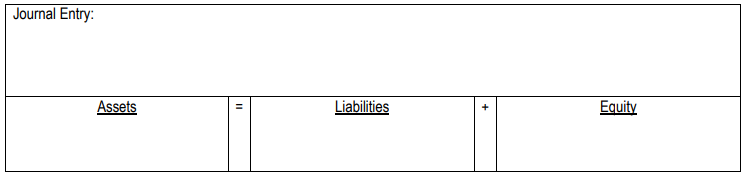

To accurately record these transactions, the system of debits and credits is employed. This system mandates that every transaction must have an equal amount of debits and credits. When recording a transaction, debits and credits must balance, ensuring that the accounting equation remains intact.

In this system, asset accounts and expense accounts increase with debits. For example, if cash is received, the cash account is debited to reflect this increase. Conversely, to decrease an asset or expense, a credit is applied. For instance, if cash is paid out, the cash account is credited.

On the other hand, liabilities, equity, and revenue accounts are increased with credits. Understanding this relationship is crucial, as it forms the basis of double-entry accounting. While it may take time to become second nature, it is essential to remember that:

- Assets and expenses increase with debits.

- Liabilities, equity, and revenues increase with credits.

As you progress in your studies, applying these principles through practical examples will enhance your understanding of how transactions are recorded and the overall impact on financial statements.