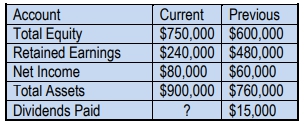

The dividend payout ratio, often referred to simply as the payout ratio, is a key financial metric that measures the percentage of a company's earnings that are distributed to shareholders in the form of dividends. This ratio is particularly relevant in the context of profitability ratios, as it involves net income. To calculate the dividend payout ratio, you take the total cash dividends paid to shareholders and divide it by the net income of the company. The formula can be expressed as:

\[\text{Dividend Payout Ratio} = \frac{\text{Cash Dividends}}{\text{Net Income}} \]

To express this ratio as a percentage, you multiply the result by 100. This gives you a clear view of how many dollars in dividends are paid out for each dollar of net income. Typically, a dividend payout ratio above 100% is unusual, as it would indicate that a company is paying out more in dividends than it earns, which is generally unsustainable.

Companies often aim to maintain a consistent dividend payout ratio year over year. For instance, a company might decide to distribute 5% of its earnings as dividends annually. However, it's important to note that not all companies pay dividends; some may choose to reinvest their earnings back into the business, which can be a strategic decision rather than a negative one.

A low dividend payout ratio can indicate that a company is reinvesting its earnings to fuel growth, which is not inherently bad. Conversely, if a company that has consistently paid dividends suddenly reduces its payout, this could signal potential financial difficulties. Investors should investigate such changes, as they may reflect a need for the company to retain earnings for operational needs or growth initiatives.

Understanding the dividend payout ratio is crucial for investors, as it provides insights into a company's financial health and its approach to returning value to shareholders. Engaging in practice problems to calculate this ratio can further solidify your understanding of its implications in investment decisions.